ifawalacatacas.com actuarial section we play a significant role in risk management it statical &

mathematical data rules for insurance & finance for industry & corporate solutions grow your business with our strategies

& marketing planner.

ifawalacatacas.com have a actuarial division . Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, finance and other industries and professions. Actuaries are professionals who are qualified in this field through intense education and experience. In many countries, actuaries must demonstrate their competence by passing a series of thorough professional examinations.

About actuarial…

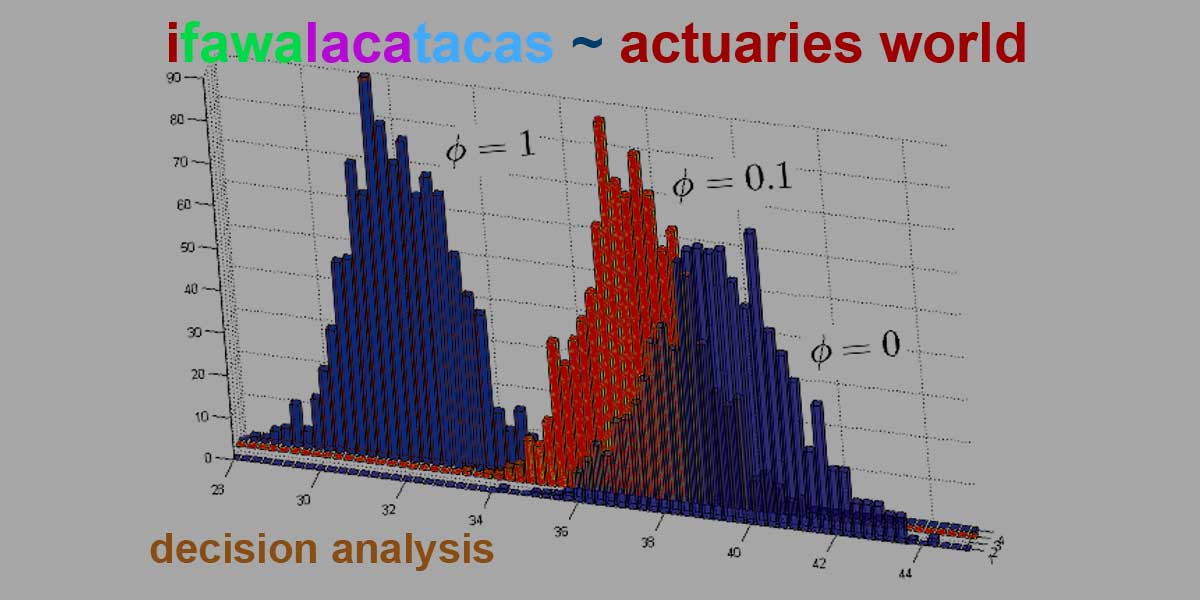

Actuarial sciences includes a number of interrelated subjects, including probability, mathematics, statistics, finance, economics, financial economics, and computer programming. Historically, actuarial science used deterministic models in the construction of tables and premiums. The science has gone through revolutionary changes during the last 30 years due to the proliferation of high speed computers and the union of stochastic actuarial models with modern financial theory .

Actuaries and accountants are two of the most unheralded yet essential professions in the financial industry. Accountants work behind the scenes to help out businesses, investors, regulators and auditors. Actuaries make it possible for insurance companies to gauge risk effectively.

Actuaries deal with tons of data – perhaps more than any other profession. These are true professional statisticians and the ultimate quants who use past data to predict likely future outcomes. Such skills make them exceedingly useful for insurance companies or other businesses that sell insurable products. For example, an actuary might be responsible for predicting how much money an insurance company will have to pay out to cover damages from future floods or forest fires. In short, actuaries are needed to develop and effectively price insurance products.

There's a great deal of variety in the accounting field, but all accountants are responsible for compiling and comparing financial records. Accountants service individuals, businesses and governments to help ensure that everything is running efficiently and accurately

life insurance, health insurance, investments and finance. Certification with the SOA is offered in five different tracks that range from life and annuities to enterprise risk management

Actuarial science became a formal mathematical discipline in the late 17th century with the increased demand for long-term insurance coverage such as Burial, Life insurance, and Annuities. These long term coverage required that money be set aside to pay future benefits, such as annuity and death benefits many years into the future. This requires estimating future contingent events, such as the rates of mortality by age, as well as the development of mathematical techniques for discounting the value of funds set aside and invested. This led to the development of an important actuarial concept, referred to as the Present value of a future sum. Pensions and healthcare emerged in the early 20th century as a result of collective bargaining. Certain aspects of the actuarial methods for discounting pension funds have come under criticism from modern financial economics.

In traditional life insurance, actuarial science focuses on the analysis of mortality, the production of life tables, and the application of compound interest to produce life insurance, annuities and endowment policies. Contemporary life insurance programs have been extended to include credit and mortgage insurance, key man insurance for small businesses, long term care insurance and health savings accounts.

In health insurance, including insurance provided directly by employers, and social insurance, actuarial science focuses on the analysis of rates of disability, morbidity, mortality, fertility and other contingencies. The effects of consumer choice and the geographical distribution of the utilization of medical services and procedures, and the utilization of drugs and therapies, is also of great importance. These factors underlay the development of the Resource-Base Relative Value Scale at Harvard in a multi-disciplined study. Actuarial science also aids in the design of benefit structures, reimbursement standards, and the effects of proposed government standards on the cost of healthcare.

In the pension industry, actuarial methods are used to measure the costs of alternative strategies with regard to the design, funding, accounting, administration, and maintenance or redesign of pension plans. The strategies are greatly influenced by short-term and long-term bond rates, the funded status of the pension and benefit arrangements, collective bargaining; the employer's old, new and foreign competitors; the changing demographics of the workforce; changes in the internal revenue code; changes in the attitude of the internal revenue service regarding the calculation of surpluses; and equally importantly, both the short and long term financial and economic trends. It is common with mergers and acquisitions that several pension plans have to be combined or at least administered on an equitable basis. When benefit changes occur, old and new benefit plans have to be blended, satisfying new social demands and various government discrimination test calculations, and providing employees and retirees with understandable choices and transition paths. Benefit plans liabilities have to be properly valued, reflecting both earned benefits for past service, and the benefits for future service. Finally, funding schemes have to be developed that are manageable and satisfy the standards board or regulators of the appropriate country, such as the Financial Accounting Standards Board in the United States.

In social welfare programs, the Office of the Chief Actuary , Social Security Administration plans and directs a program of actuarial estimates and analyses relating to SSA-administered retirement, survivors and disability insurance programs and to proposed changes in those programs. It evaluates operations of the Federal Old-Age and Survivors Insurance Trust Fund and the Federal Disability Insurance Trust Fund, conducts studies of program financing, performs actuarial and demographic research on social insurance and related program issues involving mortality, morbidity, utilization, retirement, disability, survivorship, marriage, unemployment, poverty, old age, families with children, etc., and projects future work loads. In addition, the Office is charged with conducting cost analyses relating to the Supplemental Security Income (SSI) program, a general-revenue financed, means-tested program for low-income aged, blind and disabled people. The Office provides technical and consultative services to the Commissioner, to the Board of Trustees of the Social Security Trust Funds, and its staff appears before Congressional Committees to provide expert testimony on the actuarial aspects of Social Security issues.