ifawalacatacas.com have a modern autommobile machinery accounting division.

It support industrial platform for manufacturer to provide service solution in legal & accounting

sectors like : taxation & audting of large & small all kinds of automobile sectors.

ifawalacatacas.com have business develop in automobiles equipments sectors.

Accounts and Finance Function The Accounts and Finance function is as under: Role of Accounts Finance Function: Front-line Roles:

- Fund Management

- Tax Management Support Role:

- Information Support

- Receipts & Payments

Front-line Role, i.e., fund management and tax management, which is a specialised function. Each chartered accountant possesses professional skills to carry out this function. The Support Role i.e.,jobs and tasks performed by these professionals as a support to the main business activity being carried out and other functions such as purchasing, production, marketing & sales, etc.

These roles are performed at different levels on the basis of nature of the transaction. It may be performed at the top management level or at operating level, etc. The detailed explanation of the role of Finance Professionals in Auto Industry is explained hereunder:

The total role can be bifurcated into the following sub-categories:

- Planning and Decision-making

- Budget and Costing

- Corporate Accounting & Reporting

- Transaction Accounting (Sales Accounting/ Purchase Accounting)

- Taxation: (a) Direct Tax; and (b) Indirect Tax

- Banking & Treasury

- Internal Audit and Internal Controls

1. Planning and decision-making consists of the following activities: • Strategic Planning • Feasibility

analysis for business decisions (capacity expansion, new model introduction, etc.

2. Budgeting &Costing: • Preparing revenue budgets • Preparing long term plans • Product Costing

& Contribution analysis, Ratio & Variance analysis

Finance professionals have to deal with the top management, other colleagues, statutory auditors, tax departments like the Excise Department, Sales Tax Department, Income-tax Department, etc. They also deal with other business partners like suppliers, customers, service providers, etc.

3. Corporate Accounting & Reporting: • General Ledger maintenance in compliance with Indian & International GAAPS • SEBI Compliance for Quarterly results • Arranging Statutory Audits • Reporting to Holding Companies/Group Companies, etc.

4. Transaction Accounting (Sales Accounting/ Purchase Accounting)/Fixed Asset:

a) Sales Accounting- Accounting of Sales of vehicle, Spare parts, Extended Warranty, etc. Accounting relating to marketing expenses, receivables and monitoring of default if any

b) Purchase Accounting– Payment to suppliers for various inputs services and capital equipment c) Fixed Asset - Maintaining Fixed Asset Register-Depreciation.

5. Taxation:

Direct Tax: • Direct tax planning, • Transfer pricing study & assessment, • Filing of Returns under

Direct Tax Laws, • Representing the Company in various assessment & appeals proceedings

ifawalacatacas.com workings standards.

To manage the recording of timely, complete and accurate complex accounting transactions and the balance sheet reconciliation process, for all client -related entities in order to meet regulatory requirement and contribute to the production of management reports, joint venture billings, payment schedules and statutory accounts.

Implement, manage and design financial accounting processes and complex models for a variety of financial transactions to ensure compliance with the financial terms, debt covenants, IFRS regulations.

ifawalacatacas.com Calculate and record the critically important monthly client revenue and payment processes.

Manage the financial sytems and record the construction, purchase and sharing of all client productive assets and shared assets and to manage the appropriate depreciation of these assets and other complex methodologies.

Manage the systems, record the transactions, manage the funding process and deliverthe monthly reporting for the complex client operated and non operated joint venture activities.

Review and contribute to the development of client financial systems to ensure they are appropriate for the changing needs of the business.

Manage the complex monthly cost allocation process and contribute to the preparation, co-ordination and consolidation of the client rolling work program and budget to ensure the business is able to make informed decisions about the company's future.

As part of the Extended Management Team, maintain an awareness of broader organisational and strategic issues to ensure the Department's policies and procedures meet business changes and challenges.

Provide high quality support and advisory service and acts as a source of expertise to the Finance Group, other company departments and third parties, on any aspect of company accounting processes or procedures to encourange dissemination of best practice.

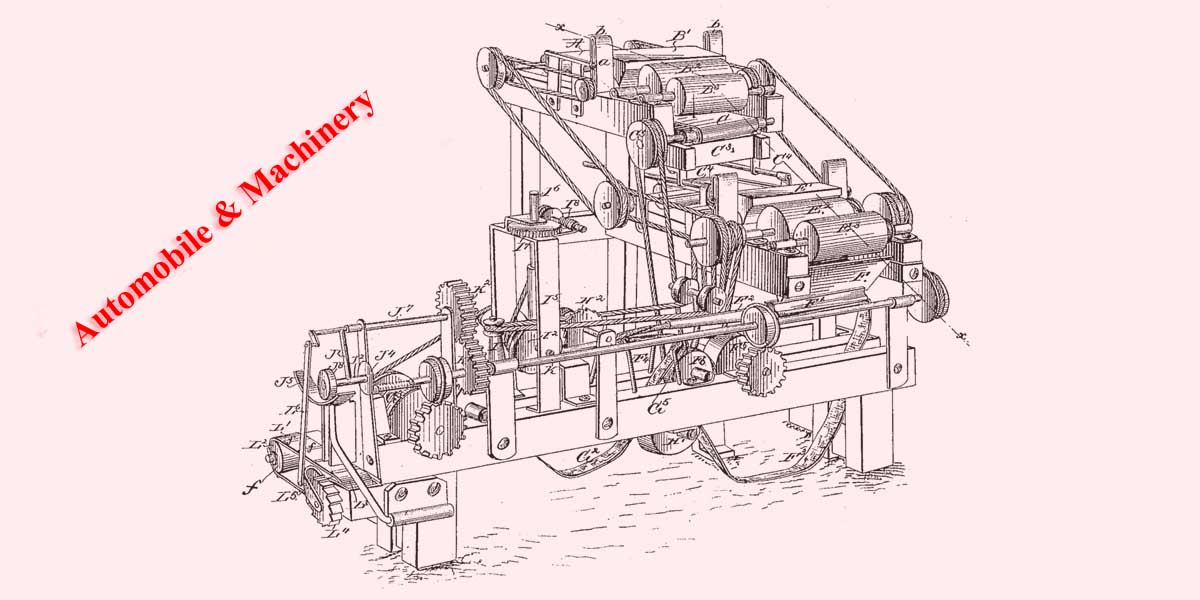

equipments and machinery

The valuation of plant and machinery and other fixed assets

Plant and machinery, furniture and fittings, motor vehicles, tools and sundry equipment are usually valued at historic cost with proper allowance for depreciation. Cost includes purchase price, freight charges, insurance- in transit and all installation costs. The purpose of depreciation in accounting is to allocate the cost of fixed assets to the several years of their useful life to the firm